Survey says: Revenue—and competition—growing for animal hospitals, plus 4 key takeaways from IndeVets

The forthcoming end of the pandemic is creating vast power shifts in animal health, as hospitals report seeing massive upswings in client demand and revenue—with a good deal of that new volume coming from competitors down the block.

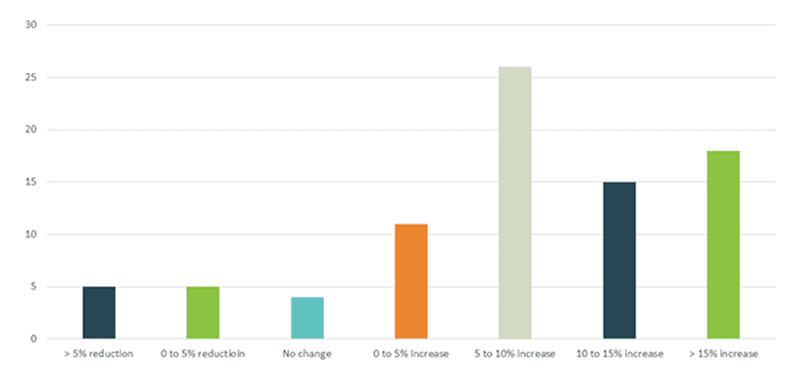

In a new survey by IndeVets of more than 100 animal hospitals, mostly clustered in the Northeast and Southeast, more than 1/3 of respondents reported increases in revenue of more than 10 percent. Close to 20 percent of hospitals said revenue was up more than 15 percent.

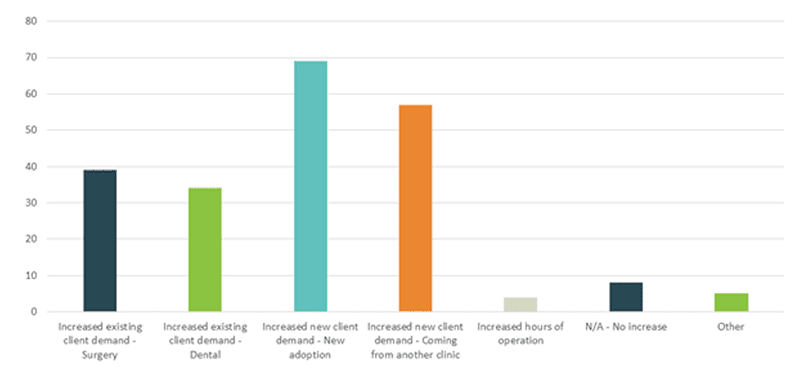

This seems to reinforce the stats reported by the AVMA and Vetsource in the Veterinary Industry Tracker. And while the greatest driver of revenue growth was new adoptions of kittens and puppies, a close second (with more than 50 percent of hospitals reporting this driver) was demand coming from another animal hospital.

This trend suggests structural shifts in the animal hospital market community that could have long-reaching implications and possibly lead to a shakeout of smaller, mom-and-pop operators—and especially solo practitioners.

Corporate consolidations and a massive influx of investment capital into animal health are leaving some operators in great positions to grow, leveraging operational expertise in key areas such as marketing and recruiting. At the same time, smaller, less capitalized hospitals are facing hiring delays and market erosion—setting some of them up for closure in the years to come.

These insights are just some of the conclusions from the latest IndeVets survey of animal hospitals and the impact of COVID-19 on operations. Since the early days of the pandemic, we’ve been tracking the impact of the pandemic. We watched as curbside care took root, and as hospitals tried—and then turned away from—telemedicine. Recently we updated our survey and found that coronavirus continues to influence the way veterinarians practice, but not always in the ways we imagined.

4 key findings from IndeVets survey data

1. Demand for appointments

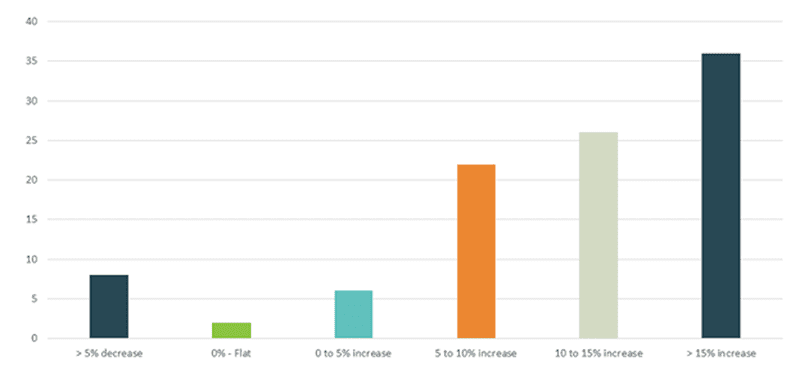

At the start of the pandemic, animal hospitals were hit hard—96 percent of respondents reported a reduction in appointments, which they attributed largely to the elimination of non-urgent procedures like dentals, surgeries, etc.

One year later, the tide has turned, with 90 percent of practices reporting an increase in appointments and 62 percent reporting an increase of 10 percent or more.

These client demands are further exacerbating the deep staffing problems facing animal health. With veterinarian unemployment below 1 percent, many hospitals are having trouble keeping up.

2. Staffing levels

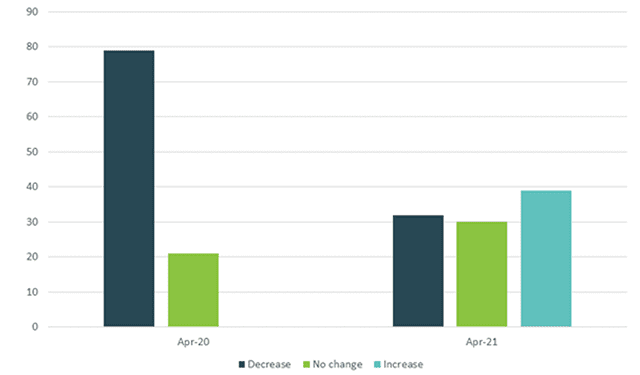

When the pandemic first hit, many hospitals reduced their hours and eliminated wellness appointments and elective procedures. In many cases, this led to a decrease in staff—79 percent of hospitals reported decreased staffing in April 2020.

One year later, 32 percent of hospitals still report a decrease in staff since COVID-19 and only 13 percent report a 10 percent or more decrease in staffing levels.

3. Curbside medicine

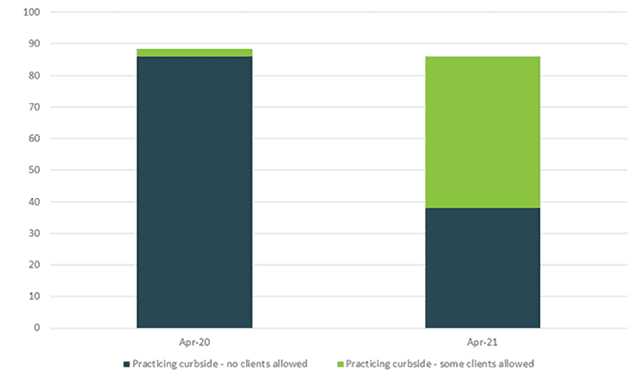

Curbside medicine was one of the early transformations during the pandemic. In spring 2020, curbside was widely adopted, with the vast majority of hospitals (85 to 92 percent) using it between March and May last year. More importantly, nine out of 10 hospitals also said they were not allowing any clients in the hospital.

A year later, 86 percent of hospitals are still practicing curbside medicine—but only 38 percent are keeping clients out of the hospital. The remaining 62 percent are allowing clients in for specific appointment types including euthanasia.

4. Telemedicine

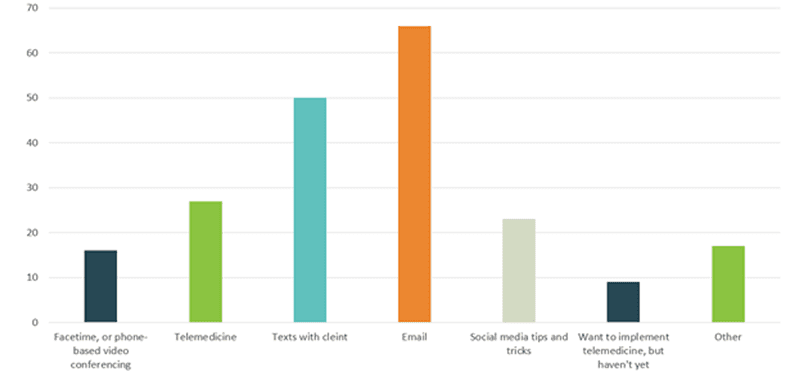

One of the biggest trends of 2020 was the growth of telemedicine services in animal health. Telemedicine companies announced partnerships with large distributors and manufacturers, racing to provide an alternative to in-person visits for pet owners. We’ve been skeptical about the ultimate uptake of this service. Not necessarily because of its value—it’s likely that hospitals can be more efficient and generate additional revenue when using telemedicine—but because animal hospitals are typically slow to adopt new business technologies.

Our data shows that our concerns appear to be on target. When we asked hospitals in 2020 if they were using telemedicine services, 30 percent said they were. In our recent survey, the number dropped to 25 percent. Regular old email remains the most popular communication tool, followed by texts and then telemedicine.

Going forward

In spring 2021 and beyond, we expect the strong demand for veterinary services to continue and possibly accelerate as the year continues. We also expect to see growth in urgent care and emergency services, which grew 25 to 30 percent at one of the largest operators of veterinary hospitals.

How has COVID-19 affected your animal hospital one year later? Drop us a note and let us know.

About the data

To see the full survey results, visit IndeVet’s COVID-19 page.

Michael Raphael is CEO of IndeVets, a veterinarian-led staffing company. IndeVets is on a mission to make veterinary medicine better by uniting the country’s best veterinarians and animal hospitals. Before founding IndeVets in 2017, Michael co-founded Community Veterinary Partners, an operator of 150+ animal hospitals. Michael has an undergraduate degree from Northwestern University and an MBA from the Fox School of Business. He lives in Philadelphia.