AVMA Webinar Recap: Key veterinary industry trends and U.S. economic insights from April 2021 presentation

You know that one friend you have who shares your same passion—maybe it’s cats, craft beer, or even pickleball? You get together and can talk for hours about your passion because they just get it. That’s what it’s like when the AVMA and Vetsource come together for a webinar on veterinary industry trends, data, and the economy.

You know that one friend you have who shares your same passion—maybe it’s cats, craft beer, or even pickleball? You get together and can talk for hours about your passion because they just get it. That’s what it’s like when the AVMA and Vetsource come together for a webinar on veterinary industry trends, data, and the economy.

Vetsource Managing Director Katie McClean had the pleasure of sitting down with AVMA Chief Economist Dr. Matthew Salois on a Friday in late April 2021. Together they presented a myriad of facts and figures on the state of the veterinary industry and the U.S. economy. Here’s a brief recap in case you missed it.

Veterinary revenue growth is higher than visits, but why?

Thanks to the Veterinary Industry Tracker powered by the AVMA & Vetsource, we’re able to see that veterinary practice revenue growth is higher than visits growth. Katie also presented that from January 2019 to March 2021, total revenue change was 9.1% and total visits change was 3%.

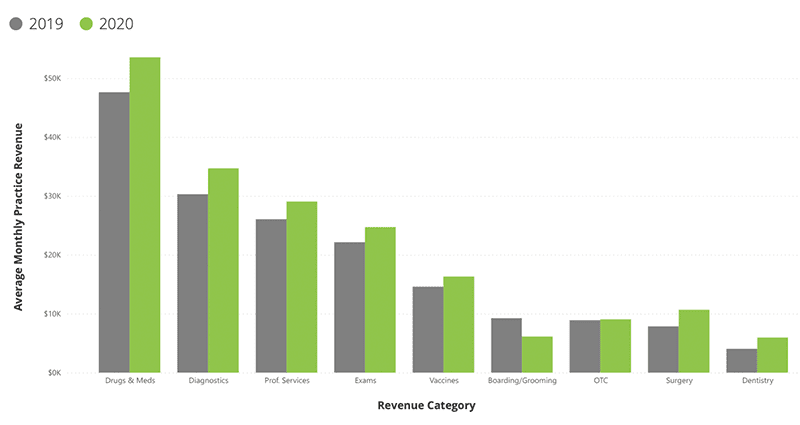

Analyzing change in revenue by category showed a rise across all categories 2020 compared to 2019, with the exception of boarding and grooming of course. A poll of webinar attendees revealed that they’ve seen the highest increase in revenue from diagnostics, and as a cat owner currently struggling to get a timely CT scan appointment, I can also back that up.

So, why is revenue higher than visits? We’re currently working with three potential factors:

- Increase in the number of products and services (line items) per visit

- Increase in the cost of each product and service purchased (more expensive line items)

- Increase in prices

Let’s take a look at each of these.

Has the number of line items per visit increased?

Long story short, yes.

In March 2019, the number of line items per visit increased 1.64% over the same month the previous year. In March 2020, that dropped to -2.97% and in March 2021, it rose to 7.22%. We can definitely see the impact that COVID-19 had on spending in 2020 compared to 2021.

Are pet owners paying for more expensive products & services?

Again, long story short, yes.

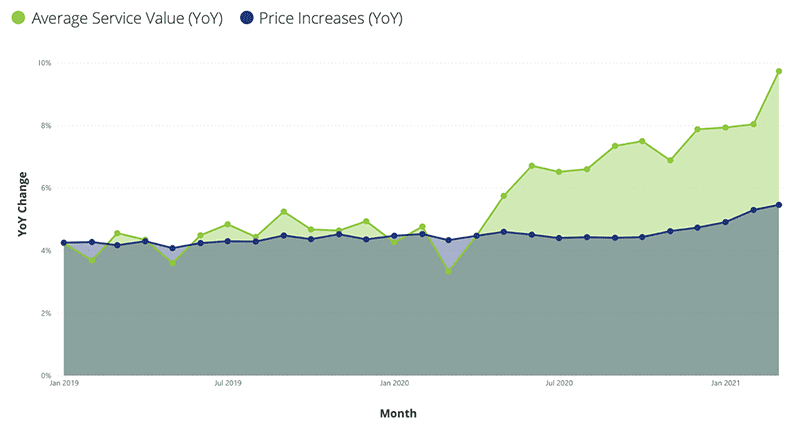

Post-March 2020, we see a significant increase in the average service value year-over-year, aka tremendous growth in average visit spending. When the data experts at Vetsource analyzed this metric they removed price increases from the equation to get a clearer picture.

Did practices increase pricing?

Yes, but not significantly enough to explain the rise in revenue. Price increases have remained consistent at about 4% and when Vetsource data experts analyzed this metric they looked specifically at the transaction price of a code over time. A poll of webinar attendees revealed that 45% increased their prices in 2020 while 45% did not.

As often happens, these answers stirred up more questions.

Which patients are contributing to revenue?

Many speculated that the increase in revenue was coming from new patients who were obtained as new pets during the pandemic, while others speculated that it was coming from existing patients whose owners were a bit more doting now working from home with increased exposure to their pets.

The data actually showed that there wasn’t a clear winner, with all types contributing to the growth in revenue at a similar rate of increase.

So, what does this all mean?

Essentially, based on the data, pet owners are saying “yes” to getting more products and services during their visits, pet owners are spending more on the products and services they do get, and practices have increased prices in 2020 and 2021.

Katie mentioned that future Vetsource analysis will dig into visits to see if there was an increase in the number of visits per patient in 2020 and 2021, plus which products and services pet owners are spending more on.

U.S. economic trends impacting the veterinary industry

AVMA Chief Economist Dr. Matthew Salois dropped some insightful economic stats in the second half of the webinar.

We discovered that consumer spending is up 10% year-over-year, with the stimulus payments and perceived control of COVID-19 certainly helping that figure. We also see that the job market is starting to recover, with job openings currently at a 2-year high. There has also been a rise in new business applications; go entrepreneurs!

Small businesses, however, are still hurting—with revenue down 25% compared to pre-COVID times—although veterinary practices appear to push against this. Consumer confidence is also still pretty low but starting to rebound at a slow, snail’s pace according to a University of Michigan consumer survey. The pressure of inflation is also increasing which may impact veterinary practices here in the near future.

Dr. Salois highlighted four fundamental shifts occurring in consumer behavior:

1. Shift to value and essentialism:

Consumers are still mindful of and perhaps conservative with their spending.

2. Flight to digital and omnichannel:

Online shopping and e-commerce are growing at epic rates.

3. Shock to loyalty:

Convenience and better value are driving 75% of consumers to try a new shopping behavior according to a McKinsey global study.

4. The homebody economy:

Consumers are likely to continue working from and investing in their homes.

A poll of webinar attendees revealed that 53% believe that curbside care is here to stay, 32% believe that it will stick around for a while but eventually go away, and 11% hope expect that it will be gone for good soon.

Veterinary industry trends: key takeaways

Dr. Salois sums it up nicely by highlighting what veterinary practices need to be mindful of moving forward:

- Price is not how you win, but it can be how you lose

- If you’re not selling online, you soon won’t be able to sell offline

- Client satisfaction is worthless; client loyalty is priceless

- Rethink how and where you connect with clients and provide patient care

One final thought really stuck with me: veterinary practices did an amazing job coping with the immense change brought on by the pandemic—Vetsource data proves that—however, practices need to remain adaptable and flexible in order to thrive moving forward.

Kate Zirkle is a Marketing Manager for Vetsource. She is passionate about animal rescue, personal development, and travel. When not working to advance the veterinary industry, she can be found kayaking, reading, and planning her next trip. You can reach her at [email protected].